TWD Monthly Market Update – June 2025

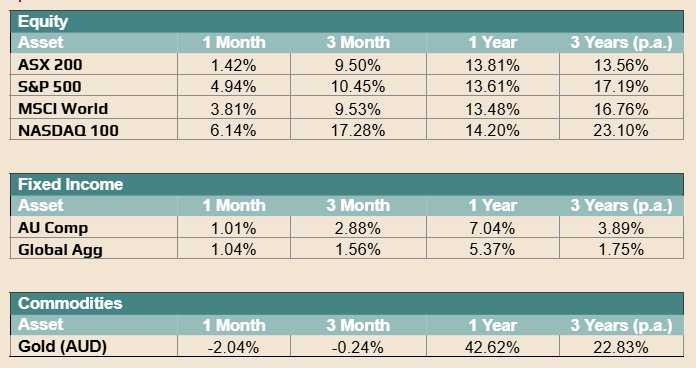

Broader Market Moves¹

Macro Commentary

June began calmly but was soon impacted by renewed volatility following the outbreak of conflict between Israel and Iran on 13 June, which later drew in the United States. By the end of the month, a ceasefire had been reached. Despite the escalation, most markets remained relatively stable. Defensive sectors and commodities saw brief gains, while broader equity markets held up, supported by solid economic fundamentals.

The Australian share market rose modestly in June, with the ASX 200 up 1.42%. Although tensions in the Middle East influenced commodity prices, investors largely looked through the longer-term implications. Sector performance varied: Energy (up 9.01%) and Financials (up 4.28%) delivered strong gains, while Materials (down 3.11%) and Consumer Staples (down 2.31%) underperformed.

Australian economic data was mixed. The May unemployment rate remained at 4.1%, with underemployment steady at 5.9%. Consumer sentiment, measured by the Westpac-Melbourne Institute Index, fell 3.5% to 82.7 in May, marking a third straight monthly decline. GDP data released in June showed annual growth of just 1.1% for the March quarter, down from 1.5%. This raised expectations that the Reserve Bank of Australia may cut rates by the third quarter.

In the United States, the S&P 500 gained 4.94% in June, breaking through 6,000 and finishing the month above 6,204. This strength came despite continued geopolitical risks and uncertainty over trade policy. The Federal Reserve left rates unchanged, with markets now expecting one rate cut in the fourth quarter as inflation continues to ease.

Tariff settings remained unchanged during the month, but attention is now turning to the 1st August deadline, after the United States extended the 90-day pause on the “Liberation Day” tariffs. If no further agreements are reached, the original tariffs will snap back at that time. Late in June, Washington finalised a new trade deal with China and indicated that accords with the European Union and India remain under negotiation.

President Trump’s “One Big Beautiful Bill,” which includes tax cuts, border security funding, and reforms to social programs, continued through the Senate after narrowly passing the House. Trump aims to sign the bill by 4 July. It is projected to add around USD 3.8 trillion to national debt over the next decade.

Oil prices briefly rose above USD 88.00 per barrel early in June amid concerns over supply disruptions through the Strait of Hormuz. Prices eased later in the month as those fears subsided. OPEC+ kept production steady, and its upcoming July meeting is expected to address further supply stability. An increase in output from key producers in August is under consideration.

Gold remained a popular safe haven. After briefly rising above USD 3,500 per ounce, it ended June lower at USD 3,303.16. The price movement reflected shifting levels of global risk throughout the month.

Looking forward, markets will remain focused on trade negotiations and developments in the Middle East. In this uncertain environment, we continue to prioritise long-term, diversified portfolios supported by strong economic fundamentals.

Disclaimer

The contents of this publication are only intended to provide a summary and general overview of matters of interest in the financial markets and in the economy and are distributed in order to promote broad discussion. The publication does not constitute investment or financial product advice, it does not constitute an offer or invitation to purchase a financial product or financial service, nor does it of itself create a client-financial adviser relationship. To the extent that any part of the contents of this publication may be said to constitute “general advice” we warn you not to act on any matter referred to in this publication without first seeking qualified financial product advice appropriate to your particular circumstances, needs and objectives before acting or relying on any content in this publication. TWD Licensee Services Pty Ltd (ABN 88 605 064 480 – AFSL 475964) makes no warranties or representations about the accuracy or completeness of the content of this publication, and excludes, to the maximum extent permissible by law, any liability which may arise as a result of the use of the content of this publication.